Unveiling the Best Forex Trading Strategy for Maximum Profit

Trading in the Forex market can be both thrilling and daunting. With currencies fluctuating due to various economic factors, implementing a solid strategy becomes imperative for every trader. Whether you’re a beginner looking to navigate your first trades or an experienced trader seeking to refine your approach, this article explores some of the best Forex trading strategies available. If you want to dive deeper into the world of Forex trading, check out best forex trading strategy https://forex-vietnam.net/, a valuable resource for traders.

Understanding Forex Trading

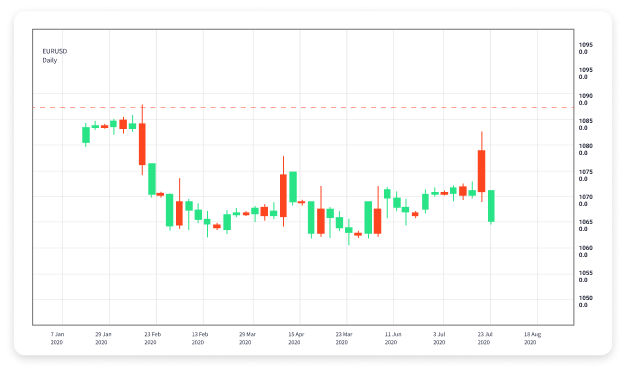

Forex, short for foreign exchange, involves trading currencies in pairs such as EUR/USD or USD/JPY. The goal is simple: to profit from the changing values of these pairs. Successful trading requires an understanding of trend analysis, risk management, and developing a sound trading plan.

The Importance of a Trading Strategy

Having a clear trading strategy is crucial in Forex trading. A trading strategy outlines your approach to entering and exiting trades and helps manage risk effectively. Without a strategy, traders often fall prey to emotional trading, leading to poor decisions and lost capital.

Popular Forex Trading Strategies

1. Trend Following Strategy

The trend-following strategy is one of the most popular approaches in Forex trading. This strategy involves identifying the current market trend—whether it’s upward (bullish), downward (bearish), or sideways—and making trades that align with that trend. Traders typically use technical analysis tools like moving averages and momentum indicators to forecast the continued movement of currency pairs.

2. Range Trading Strategy

Range trading is ideal for markets that exhibit little volatility, characterized by price movements that trade between established support and resistance levels. Traders employing this strategy look for reversal points to make profitable trades. This strategy works best in a stable market and can be supported by oscillators and technical indicators that highlight overbought or oversold conditions.

3. Breakout Strategy

Breakout trading focuses on entering the market following significant price movements when the price breaks through a major support or resistance level. The idea is that once a breakout occurs, the price will continue to move in the direction of the breakout. Traders often use volume indicators to confirm the strength of the breakout.

4. Swing Trading

Swing trading typically involves holding positions for several days to capitalize on expected upward or downward market shifts. This strategy is less dependent on technical indicators and more focused on market sentiment, news events, and economic data releases. Traders often look for swings within the trend to enter trades.

Risk Management in Forex Trading

No trading strategy is complete without a solid risk management plan. Good risk management is critical for preserving capital and ensuring longevity in trading. Here are key components to consider:

- Position Sizing: Determine the amount of your capital to risk on each trade.

- Stop-Loss Orders: Use stop-loss orders to automatically close a trade when certain loss thresholds are reached.

- Diversification: Avoid putting all your capital into one trade; diversify across different pairs or strategies.

- Consistent Review: Regularly review and adjust your trading strategy based on performance and changing market conditions.

Tools and Resources for Forex Trading

To streamline your trading process, you can utilize various tools and resources:

- Trading Platforms: Software like MetaTrader provides essential tools for technical analysis and trade execution.

- Economic Calendars: Stay updated with market news and indicators that can influence currency movements.

- Trading Journals: Maintain a journal to log your trades, thoughts, and strategies for future improvement.

Conclusion

Finding the best Forex trading strategy is a personal journey that depends on your trading style, risk tolerance, and market understanding. Whether you choose to follow trends, trade ranges, breakouts, or swing trades, it’s vital to stay disciplined and utilize effective risk management techniques. Continuous learning and adapting to market changes will empower you to evolve your strategies and succeed in the Forex market. Remember to start with a demo account if you’re new to trading and give yourself time to practice before risking real capital. Happy trading!

Son Yorumlar